What Are Health Savings Accounts?

• Health savings accounts (HSAs) are personal savings accounts that are paired with high-deductible health insurance plans.

• HSAs offer a triple tax benefit: Contributions aren’t taxed, they grow tax-deferred, and the money can be used tax-free for eligible medical expenses.

• In an HSA, you can invest your contributions so your balance can build over time.

Having a high-deductible health plan does more than just lower your insurance premiums. It also makes you eligible for a tax-friendly health savings account to help you cover out-of-pocket medical expenses.

With an HSA, your contributions are tax-deductible—or pretax if you contribute through your employer. Your invested money grows tax-sheltered. And you can pull the money out tax-free at any time to pay qualified medical expenses. This makes an HSA even more tax advantageous than a 401(k), Roth IRA, or 529 college-savings plan.

How Health Savings Accounts Work

There is no income limit to qualify for an HSA. But you must be enrolled in an HSA-eligible high-deductible health plan. That means the plan must have a deductible of at least $1,400 for individual coverage or $2,800 for a family coverage for 2020. Your out-of-pocket costs, though, are capped. For 2020, they can’t exceed $6,900 for an individual and $13,800 for a family.

Most employees access an HSA through an employer. But if your employer doesn’t offer one, you can invest in one on your own from outside providers, such as banks or investment firms.

The most you can contribute to an HSA in 2020 is $3,550 for single coverage and $7,100 for family coverage. If you’re 55 or older, you can kick in an extra $1,000. Your pre-tax contributions will be automatically deducted from your paycheck if your HSA is through your employer. If you enroll in an HSA outside of work, you can deduct your contributions on your tax return even if you don’t itemize. You have until the April tax deadline to make contributions for the previous year. So, you can make contributions for 2019 up until April 15, 2020. (The maximum contribution for 2019 is $3,500 for singles and $7,000 for families). And you can make contributions for 2020 up until April 15, 2021.

HSAs often offer a broad investment menu, including mutual funds and exchange-traded funds. Many providers, though, require that you keep $1,000 to $2,000 in the HSA’s cash account—which might pay interest—before you graduate to investing.

How to Use Health Savings Account Funds

You can use the money tax-free at any time to pay for qualified medical expenses, ranging from acupuncture and hearing aids to weight loss programs and x-rays. You can even use the HSA to pay premiums for Medicare Part B, Part D prescription-drug coverage, and Medicare Advantage plans (but not Medigap premiums). The IRS lists qualified expenses in Publication 502. You pay the bills from your account generally by using a check, debit card, or electronic payments.

Use the money for non-medical purposes, and you’ll owe income taxes and a 20% penalty on the distributions. (After age 65, the 20% penalty disappears.)

Benefits of Health Savings Accounts

Some employers encourage participation in a high-deductible plan by adding money to workers’ HSAs. Among those that do this, the average contribution in 2019 is $768 for singles and $1,433 for families, according to Kaiser Family Foundation (KFF). Any employer contribution counts toward your annual contribution limit.

To get the most out of your HSA, pay your current medical bills out-of-pocket—if you can afford to. This gives your invested dollars more time to grow. And as long as you save the receipts, you can reimburse yourself years later for those out-of-pocket expenses using HSA money.

An HSA has no “use-it-or-lose-it” catch like with a Flexible Spending Account. Any money you have left over in the account at the end of the year is rolled over into the next. And you aren’t required to take distributions from an HSA after age 70½ as you must with a 401(k) or traditional IRA.

You will need to select a beneficiary of the account who will inherit it after your death. If you name a spouse, the account will then be treated as his or her HSA. Name someone other than a spouse, and the account will be closed and the money disbursed to the beneficiary and subject to tax.

Drawbacks of Health Savings Accounts

While there are no restrictions on when you must use the HSA money, there are limits on when you can contribute. You can’t contribute once you enroll in Medicare.

The deductibles in health plans with HSAs can also be steep. The average annual deductible in 2019 is $2,476 for single coverage and $4,673 for family coverage, according to KFF. That’s how much you would need to pay out of pocket before insurance kicks in, which can be a high hurdle for many.

HSA fees can also be high—and not that transparent, notes a survey by Morningstar. You’ll pay an annual fee for the mutual fund or ETF you invest in. On top of that, some HSAs charge a fee for annual maintenance, paper statements, check writing, closing or opening the account, and more.

In addition, the interest your money earns sitting in the cash account ranges widely, with most providers leaning toward the stingier side, the Morningstar survey found. Yields ranged from 0.01% to 1.07%, That translates to a range of 20 cents to $21 dollars per year in interest on a $2,000 balance.

Also, if you’re frequently tapping an HSA to pay current medical bills, it will be difficult to build up much of a balance to invest. And you would lose one of the key benefits: letting your invested dollars grow and compound over time.

Considerations for Enrolling in an HSA

An HSA can be part of an overall savings strategy. Your best option may be the HSA offered through your employer’s plan. Not only will your pre-tax contributions be automatically deducted from your paycheck, but that money also won’t be subject to Social Security and Medicare taxes. And the employer might pick up the cost of any HSA monthly maintenance fee for you.

If an HSA through an employer isn’t an option—or you don’t like the provider—you can invest in an HSA on your own outside of work. Your contributions are tax-deductible, although you’ll still owe payroll taxes on the money.

To navigate the hundreds of banks and investment firms offering HSAs, go to HSASearch.com. The site lets you compare the fees, investment options, and interest rates offered by providers.

Before enrolling in any HSA, consider the investment options and whether they are broad enough for you to develop a diversified portfolio. This includes small- to large-cap stocks, foreign and domestic stocks, investment-grade bonds, short-term bonds and money market funds.

Last, review the fees that can erode your account. For example, some HSAs don’t have a maintenance fee, while others charge $42 or $45 a year, according to Morningstar.

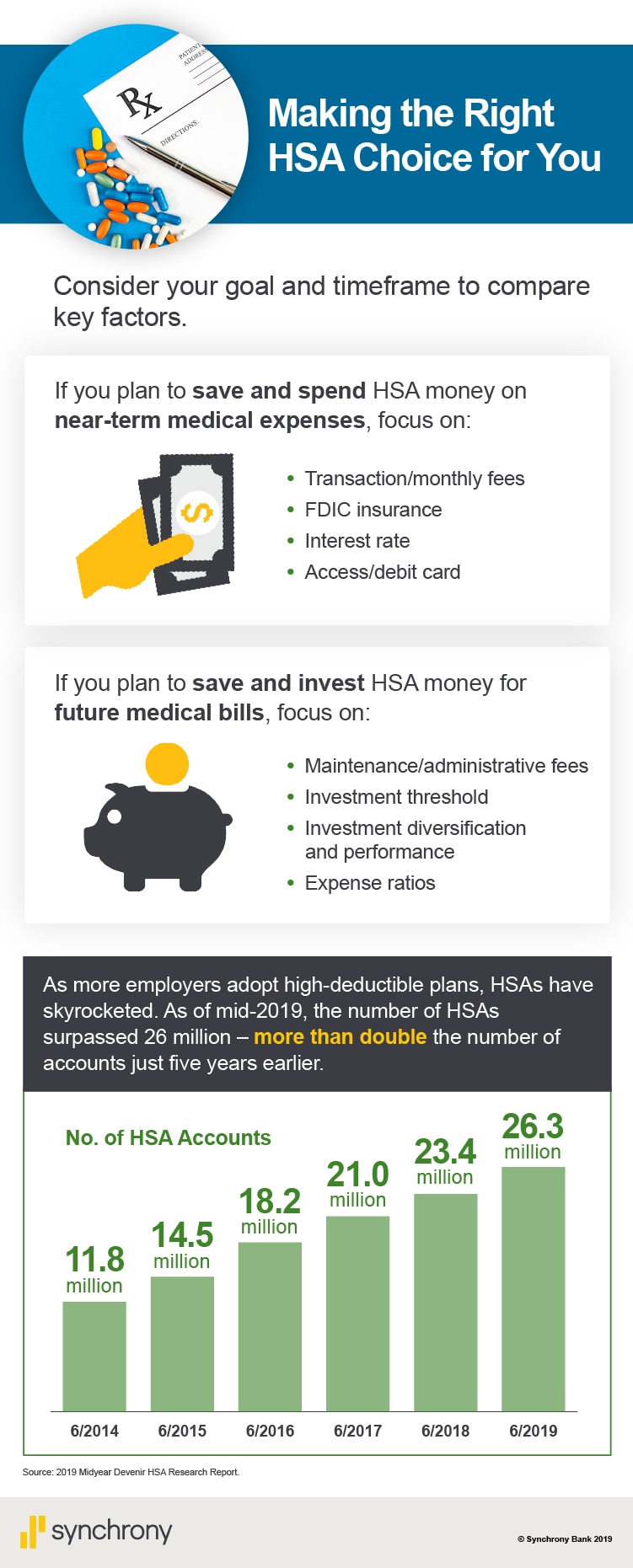

This is a chart called “Tracking the Remarkable Growth of HSAs.” As more employers adopt high-deductible plans, HSAs have skyrocketed. As of mid-2019, the number of HSAs surpassed 26 million – more than double the number of accounts just five years earlier. Making the Right HSA Choice for You. Consider your goal and timeframe to compare key factors. For example, if you plan to save and spend HSA money on near-term medical expenses, focus on Transaction/monthly fees, FDIC insurance, Interest rate, Access/debit card. If you plan to save and invest HSA money for future medical bills, focus on Maintenance/administrative fees, Investment threshold, Investment diversification and performance, Expense ratios.