By Synchrony Staff

- UPDATED April 23

- |

- 2 MINUTE READ

Automatic transfers make achieving your savings goals easier by taking you out of the equation. All you have to do is set it and forget it. Here are 4 steps to take today.

Step 1: Outline Your Intentions. What are you saving for? What's your total savings goal? How long do you have to save?

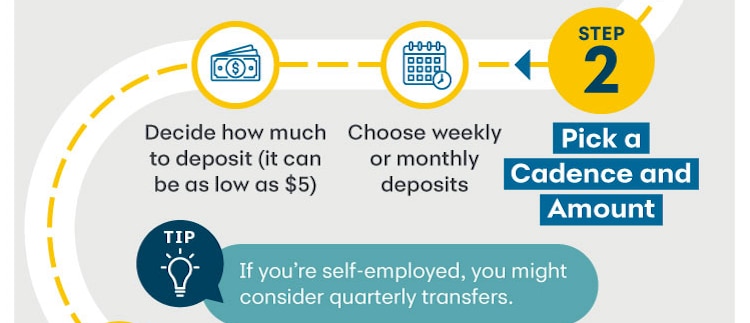

Step 2: Pick a Cadence and Amount. Choose weekly or monthly deposits. Decide how much to deposit.

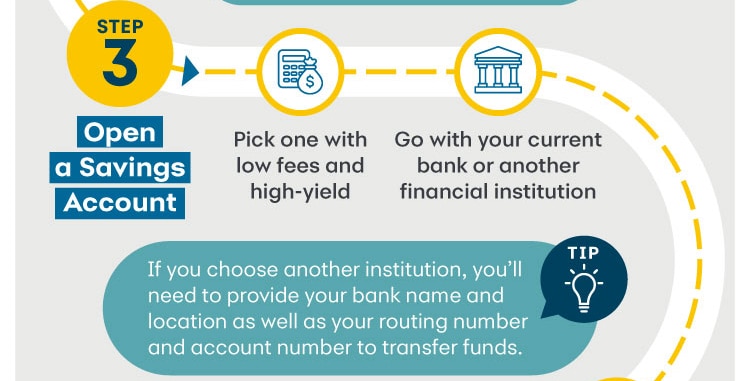

Step 3: Open a Savings Account. Pick one with low fees and high yield.

Step 4: Choose Your Automation. Account transfer: taken from your checking account. Or Direct deposit: taken from your direct deposit paycheck.

To get started, learn more about savings accounts to automate your savings at Synchrony Bank.

READ MORE: 40 Simple Ideas for How to Save Money Fast