Using several varieties of savings accounts can be the key to earning the highest interest rates, while making sure you always have easy access to your money in case you need to cover an unexpected expense.

For money you want to save but need to be able to withdraw from an ATM when necessary, a high yield savings account or a money market account (MMA) is a smart option. Each typically offers higher interest rates than a standard savings account, and with the same level of flexibility.

With both a high yield savings account and a money market account, the Federal Reserve Board limits you to six withdrawals (or transfers) per month. ATM and teller withdrawals do not count against this limit, but debit card transactions, checks and online transfers do. If you want to write a few checks from your savings each month, a money market is the way to go, as this feature is not available with standard or high yield savings accounts.

While a money market account and a high yield savings account are smart choices for emergency funds, a certificate of deposit (CD) is worth considering for any money you know you will not need within a short period. A CD requires you to keep your money deposited for a fixed period of time. It can be 3 months, 6 months, 1 year, 5 years or even longer. The interest rate on a CD can often be higher than what you’d earn on a high yield savings account or money market account. Moreover, the interest rate on a CD is fixed for its duration; it won’t change from the initial rate between when you open it and when it matures. Both savings accounts and money market accounts have variable rates that can change from time to time.

The trade-off for the higher fixed interest rate available on a CD is liquidity. You can’t withdraw money from a CD at an ATM or by check. If you decide to withdraw your money before the CD matures, you will pay an early withdrawal penalty.

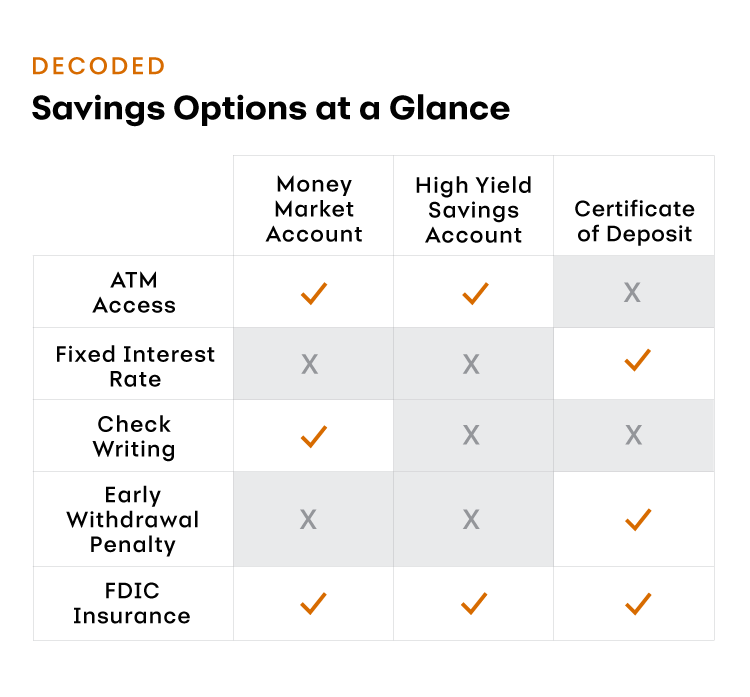

This chart is titled "Decoded: Savings Options at a Glance." It compares three types of accounts: money market accounts, high yield savings accounts and certificates of deposit. Money market accounts have ATM access, allow checks and are FDIC insured; they do not have a fixed interest rate or an early withdrawal penalty. High yield savings accounts have ATM access and are FDIC insured; they do not have fixed interest rates, allow checks or have an early withdrawal penalty. Certificates of deposit have fixed interest rates, early withdrawal penalties and are FDIC insured; they do not have ATM access and do not allow check writing.

Carla Fried is a freelance journalist specializing in personal finance. Her work appears in the New York Times, Money magazine, Consumer Reports and CNBC.com.