Volatile stock markets can turn the most level-headed person into a jittery, insomnia-plagued mess. But just because the markets are unstable doesn’t mean your investment strategy should be, too.

So it’s essential to fight the urge to make impulsive decisions. Trying to recover losses by timing the market for a big score is not something investment professionals recommend. And putting your cash under a mattress isn’t the way to go, either.

But there are ways to protect and grow your money while the markets yo-yo. With a little introspection, diversification and patience, even the most nervous market-watchers can stabilize their portfolios and breathe easy.

That starts with making sure you keep a portion of your long- and short-term investments in savings accounts, money market accounts and other cash investment instruments. This will limit your exposure to losses and lower your anxiety level.

Goals + Timing = Strategy

But loss prevention can, to a certain degree, limit your returns. So how do you strike a balanced investment plan?

One way is to define your long- and short-term financial goals. What are you saving for—college, a down payment on a house, a car? How much are you able to contribute toward your retirement savings? How much risk are you comfortable taking? When do you anticipate you’ll need to use your investments? Once you are armed with clear answers, you’ll be ready to look at how you’re investing and saving with fresh eyes.

Know Your Options

For the portion of your money that you’ll need soon, or the portion that you need to keep in FDIC-insured accounts for the sake of your sanity, consider these:

Savings Accounts

Savings accounts, especially high yield savings accounts that require no minimum balance, are among the most flexible ways to save and spend. The rate of return varies from bank to bank, but you are getting a guaranteed rate—some banks are offering 1.7% rates of return as of March 2020—and you can access your cash as soon as you need it.

Money Market Accounts

Money market accounts operate like hybrid checking and savings accounts. You can access your money on- or offline and write checks—although some money markets cap the number of checks you can write. Meanwhile, your cash also generates income.

CDs

Certificates of deposit (CDs) guarantee a fixed-rate return at the end of a designated period of time. The longer the term—you can choose terms between six and 60 months—the higher the rate of return.

IRA CDs & Money Market Accounts

If you’re saving for retirement, consider opening either a traditional or Roth Individual Retirement Account, which both carry tax breaks for investors. Roth IRA contributions are made with after-tax dollars, so your earnings are tax-free after age 59. Traditional IRAs may allow you to take up to a $6,000 or $7,000 (depending on your age) tax deduction for your contribution. You can open an IRA CD, IRA money market account or investment fund account.

However you approach the markets, or your savings goals, keeping a healthy portion of your portfolio in savings can be just the ticket to getting through periods of volatility calmly—and profitably.

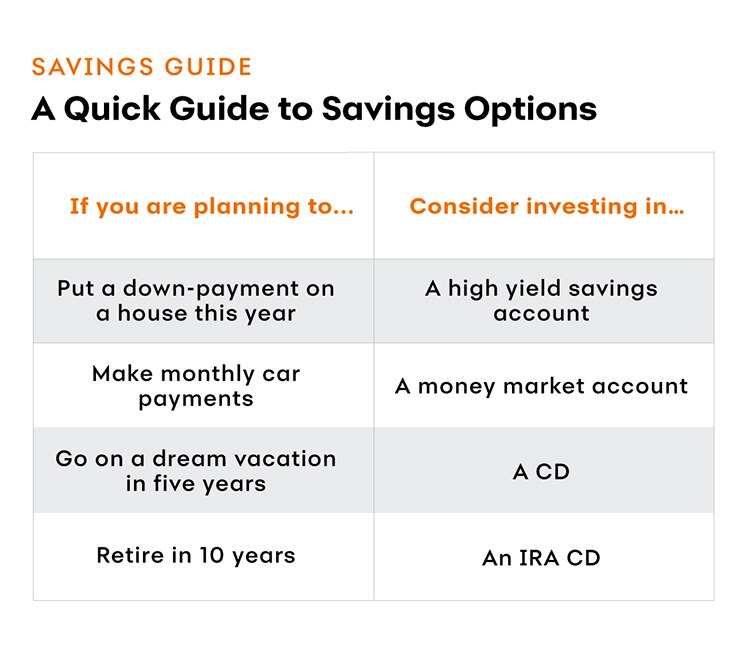

This chart is in the category "Savings Guide" and is titled "A Quick Guide to Savings Options." If you are planning to put a down-payment on a house this year, consider investing in a high yield savings account. If you are planning to make monthly car payments, consider investing in a money market account. If you are planning to go on a dream vacation in five years, consider investing in a CD. If you are planning to retire in 10 years, consider investing in an IRA CD.

Seth Kaufman is a journalist and ghostwriter based in Brooklyn, New York. His work has appeared in The New York Times, The New Yorker online and many other publications.

Illustration by Megan Berkheiser.

Learn more about where to keep your money with these 3 Good Places to Stash Your Cash.