If you’re in the first few years of your career, you’ve almost certainly heard about the importance of saving for the future, but you may feel as though investing puts you at risk of financial whiplash. In the back of your mind, you might be thinking about the Great Recession, which was one of the longest economic downturns in history and included a sharp decline in stock prices. And now the COVID-19 pandemic has cost millions of Americans their jobs and caused stock markets to swing wildly.

These ups and downs might lead you to put off making major money choices. But now is actually an ideal time to learn about financial risk and how you feel about taking it on. Risk will always be a part of big financial decisions, and like it or not, so will your emotions. The earlier you can understand how these two factors affect each other, and you, the better positioned you’ll be to shape your financial future. The first step is to understand the different kinds of risk.

What Is Financial Risk?

You encounter risk—the chance that something bad will happen—every time you make a decision. Plan an outdoor birthday party, and you risk the weather being too hot, too cold, too cloudy, too anything. Invest, and you take on financial risk, which is the chance that you’ll lose money.

The most commonly available investments fall into three categories, each with its own typical level of risk: stocks, bonds and cash.

● A stock is a share of a company, and its value could skyrocket if the company becomes incredibly successful or go to zero if the company shuts down. Stocks generally have the highest level of risk but also the highest potential reward.

● A bond is a form of debt. Companies and governments issue bonds, use the money and pay back your original investment in the future, plus interest. Bonds typically have lower risk but also lower potential reward than stocks.

● Cash, be it in paper form or in an investment or savings account, carries the lowest amount of risk and reward.

You choose how to spread your money across these investment types, and your choice, also known as your asset allocation, is a key determinant of your portfolio’s risk.

What Is Your Risk Tolerance?

Most financial experts recommend that younger people invest most of their retirement savings in stocks, with some recommending all-stock portfolios for people in their 20s. You reap the typically higher returns, and if stock values crash, you have decades to recover any losses, even though you may not need nearly that long. For example, the markets recovered their losses about four years after hitting bottom in 2009 during the Great Recession.

Over time, experts recommend shifting your retirement account asset allocation to reduce risk, going from all or mostly stocks in your 20s to about 60% stocks and 40% bonds when you’re near retirement.

Not everyone feels comfortable with an all-stock retirement portfolio, though, even in their 20s. If you take on more risk than you can tolerate, you may overreact when the next crash comes, sell your stocks at a loss and end up worse off than if you’d invested more conservatively and held for the long term.

So, if you worry every time you hear about stock market sell-offs, use time to your advantage. Save more now, and you can take on less risk because your investments have so much time to grow. Save too little now, and you’ll have to take on more risk later to try to get higher rewards.

What Does Risk Have to Do with Saving Money?

Retirement isn’t the only goal you’re likely saving for. You probably have plans for everything from a house down payment to the latest smartphone. Understanding risk can help you save for these, too.

The key is compartmentalizing based on when you’ll need your savings. For example, if you put your phone fund into stocks and they plummet, you’ll have to delay or even cancel your upgrade. Allocate your entire retirement account to cash, and you may not accumulate enough to pay your bills later in life.

In general, money you need within the next three years is best kept in a high yield savings account that is protected by the FDIC. For money you’ll want to spend in three to 10 years, a certificate of deposit offers higher returns than a savings account and still comes with very little risk. For money you’ll need in 10 years or more, consider stocks and bonds to increase your potential returns.

What Else Should I Know About Risk?

Remember that higher risk simply indicates the potential for higher returns; it doesn’t guarantee them.

Consider that your financial situation and risk tolerance will change. In 20 years, you’ll be in your prime earning years, but you’ll probably also have more financial obligations, such as saving for a child’s college education.

Finally, think about how long you’ll need to live off your retirement savings. You may wait until age 70 or even older to retire, yet you’ll still need money to fund another three decades of living expenses. All of these factors will affect how much you’ll need to save, how much risk you’ll need to take on and your risk tolerance—another reason it’s so important to use time to your advantage and learn about risk now.

Curious to see if you’re on track with your retirement savings? Find answers here.

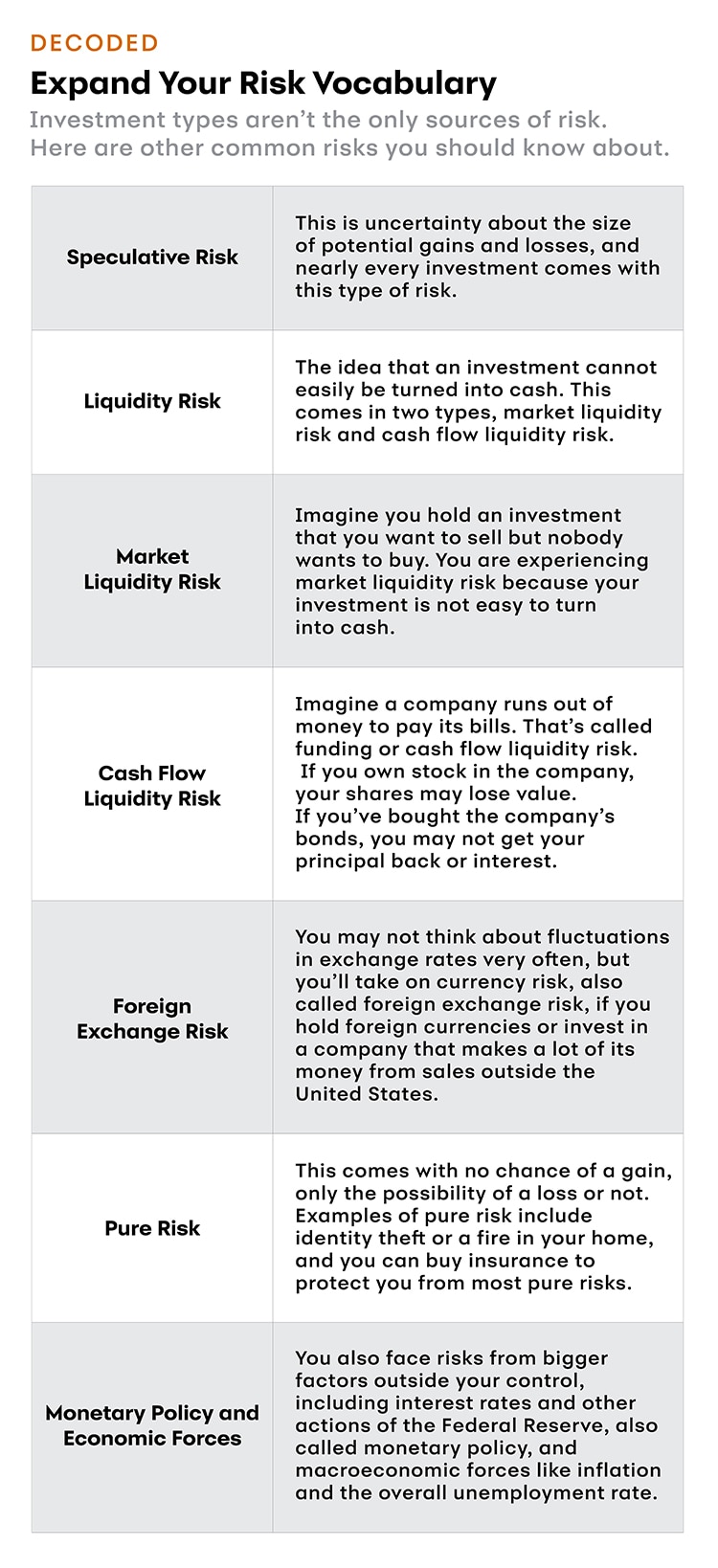

This chart is called Expand Your Risk Vocabulary. Investment types aren’t the only sources of risk. Here are other common risks you should know about. Speculative Risk.This is uncertainty about the size of potential gains and losses, and nearly every investment comes with this type of risk.Liquidity Risk. This means that an investment cannot easily be turned into cash. It comes in two types: market liquidity risk and cash flow liquidity risk. Market Liquidity Risk. Imagine you hold an investment that you want to sell but nobody wants to buy. You are experiencing market liquidity risk because your investment is not easy to turn into cash. Cash Flow Liquidity Risk. Imagine a company runs out of money to pay its bills. That’s called funding or cash flow liquidity risk. If you own stock in the company, your shares may lose value. If you’ve bought the company’s bonds, you may not get your principal back or interest. Foreign Exchange Risk. You may not think about fluctuations in exchange rates very often, but you’ll take on currency risk, also called foreign exchange risk, if you hold foreign currencies or invest in a company that makes a lot of its money from sales outside the United States.Pure Risk. This comes with no chance of a gain, only the possibility of a loss or not. Examples of pure risk include identity theft or a fire in your home, and you can buy insurance to protect you from most pure risks.Monetary Policy and Economic Forces. You also face risks from bigger factors outside your control, including interest rates and other actions of the Federal Reserve, also called monetary policy, and macroeconomic forces like inflation and the overall unemployment rate.

Elizabeth Whalen is a freelance writer based in Seattle. She loves writing about business, financial services and sustainability.

Learn more about managing cash in uncertain times.