Press Release

October 22, 2014, 10:38 AM EDT

Published by Synchrony on October 22, 2014, 10:38 AM EDT

Synchrony Financial Forecasts Moderate 2014 Holiday Retail Sales Growth of 3.5 Percent

Dateline:

STAMFORD, Conn.

Public Company Information:

NYSE: SYF

STAMFORD, Conn.--(BUSINESS WIRE)--Holiday sales this year are expected to grow 3.5 percent, according to Synchrony Financial (NYSE:SYF), a premier consumer financial services company with 80 years of retail heritage. This estimate is in line with the 10-year historical average of 3.3 percent. Seasonally adjusted sales for November and December 2013 were $505.5 billion, and 2014 sales are expected to top this figure by more than $17 billion. This includes all online and offline purchase made in core retail categories.*

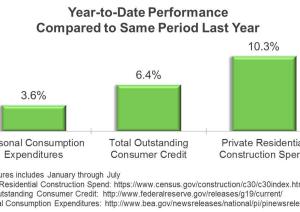

This outlook for the 2014 holiday season is based on a number of indicators such as unemployment, gas prices, private residential construction, as well as non-traditional indicators Synchrony Financial identified as effective in developing its forecast. In addition to a steadying labor market, long-term strength in key economic indicators of personal consumption expenditures, consumer credit, and residential construction have produced a supportive environment for advancing retail sales. This year, increasing access to consumer credit and improving home equity have helped consumers spend with confidence. Year-over- year through August, consumers made $64.5 billion more in retail sales purchases, after adjusting for seasonality.

“We developed our Holiday Retail Sales forecast, analyzing multiple factors that influence shopping across segments,” said Toni White, chief marketing officer of Synchrony Financial. “These findings are supported by research we conduct in other areas, which indicates consumers are confident, yet cautious in making purchases, and increasingly use digital tools to research, compare deals and buy.”

Retail sales have kept pace with the gradual strengthening of the broader economy. From January to August 2014, retail sales categories of Non-store/E-retailers and Health & Personal Care led percentage gains and are up 6.7 percent and 6.3 percent, respectively, year-over-year. Last holiday season, both of these categories had strong year-over-year performance, as did specialty retailers. Although it is yet to be seen which categories will lead holiday advances in 2014, results of Synchrony Financial’s recently issued third annual Major Purchase Consumer Study** indicate that while consumer confidence is rising, value overwhelmingly drives a major purchase decision, with more than 88 percent of accountholders surveyed, indicating they “always seek the best deal.”

Similar to last year, there is a shortened shopping period of 26 days between Black Friday and Christmas 2014, compared to 31 days in 2012. This impact to the full two-month holiday sales period is mitigated by consumers’ shift to online and mobile shopping. The accessibility afforded by these channels has reduced delayed purchases of hard-to-find products and late season, in-store deal shopping. For the full fourth quarter of 2013, e-commerce sales accounted for six percent of total retail sales, and were up +15.7 percent from the previous year.

About Synchrony Financial

Formerly GE Capital Retail Finance, Synchrony Financial (NYSE: SYF) is one of the premier consumer financial services companies in the United States. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ more than 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Our offerings include private label credit cards, promotional financing and installment lending, loyalty programs and Optimizer+plus branded FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

*Synchrony Financial defines retail holiday sales as November 1 - December 31, and core holiday categories as: department stores, general merchandise, clothing, specialty, non-store, home, and grocery; this excludes retail sales at restaurants, gas stations, and motor vehicle dealers.

**The 2014 Major Purchase Consumer Study reflects the average experience of consumers making purchases valued at $500+ in one of 12 categories. Findings exclude shoppers who made a purchase during the holidays (Black Friday-Dec.) to represent the average purchase in these categories and includes some product category differences due to the need to replace or repair (i.e., appliance, automotive services, and eyewear shoppers may have a shorter consideration cycle).

Cautionary Statement Regarding Forward-Looking Statements

This news release may contain certain forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the "safe harbor" created by those sections. Forward-looking statements may be identified by words such as “outlook,” “expects,” “intends,” “anticipates,” “plans,” “believes,” “seeks,” “targets,” “estimates,” “will,” “should,” “may” or words of similar meaning, but these words are not the exclusive means of identifying forward-looking statements. Forward-looking statements are based on management’s current expectations and assumptions, and are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict. As a result, actual results could differ materially from those indicated in these forward-looking statements. Factors that could cause actual results to differ materially include global political, economic, business, competitive, market, regulatory and other factors and risks, such as: the impact of macroeconomic conditions and whether industry trends we have identified develop as anticipated; retaining existing partners and attracting new partners, concentration of our platform revenue in a small number of Retail Card partners, promotion and support of our products by our partners, and financial performance of our partners; our need for additional financing, higher borrowing costs and adverse financial market conditions impacting our funding and liquidity, and any reduction in our credit ratings; our ability to securitize our loans, occurrence of an early amortization of our securitization facilities, loss of the right to service or subservice our securitized loans, and lower payment rates on our securitized loans; our reliance on dividends, distributions and other payments from Synchrony Bank; our ability to grow our deposits in the future; changes in market interest rates and the impact of any margin compression; effectiveness of our risk management processes and procedures, reliance on models which may be inaccurate or misinterpreted, our ability to manage our credit risk, the sufficiency of our allowance for loan losses and the accuracy of the assumptions or estimates used in preparing our financial statements; our ability to offset increases in our costs in retailer share arrangements; competition in the consumer finance industry; our concentration in the U.S. consumer credit market; our ability to successfully develop and commercialize new or enhanced products and services; our ability to realize the value of strategic investments; reductions in interchange fees; fraudulent activity; cyber-attacks or other security breaches; failure of third parties to provide various services that are important to our operations; disruptions in the operations of our computer systems and data centers; international risks and compliance and regulatory risks and costs associated with international operations; catastrophic events; alleged infringement of intellectual property rights of others and our ability to protect our intellectual property; litigation and regulatory actions; damage to our reputation; our ability to attract, retain and motivate key officers and employees; tax legislation initiatives or challenges to our tax positions and state sales tax rules and regulations; significant and extensive regulation, supervision, examination and enforcement of our business by governmental authorities, the impact of the Dodd-Frank Act and the impact of the CFPB’s regulation of our business; changes to our methods of offering our CareCredit products; impact of capital adequacy rules; restrictions that limit our ability to pay dividends and repurchase our capital stock and that limit Synchrony Bank’s ability to pay dividends; regulations relating to privacy, information security and data protection as well as anti-money laundering and anti-terrorism financing laws; use of third-party vendors and ongoing third-party business relationships; effect of General Electric Capital Corporation (GECC) being subject to regulation by the Federal Reserve Board both as a savings and loan holding company and as a systemically important financial institution; General Electric Company (GE) not completing the separation from us as planned or at all, GE’s inability to obtain savings and loan holding company deregistration (GE SLHC Deregistration) and GE continuing to have significant control over us; completion by the Federal Reserve Board of a review (with satisfactory results) of our preparedness to operate on a standalone basis, independently of GE, and Federal Reserve Board approval required for us to continue to be a savings and loan holding company, including the timing of the approval and the imposition of any significant additional capital or liquidity requirements; our need to establish and significantly expand many aspects of our operations and infrastructure; delays in receiving or failure to receive Federal Reserve Board agreement required for us to be treated as a financial holding company after the GE SLHC Deregistration; loss of association with GE’s strong brand and reputation; limited right to use the GE brand name and logo and need to establish a new brand; GE has significant control over us; terms of our arrangements with GE may be more favorable than we will be able to obtain from unaffiliated third parties; obligations associated with being a public company; our incremental cost of operating as a standalone public company could be substantially more than anticipated; GE could engage in businesses that compete with us, and conflicts of interest may arise between us and GE; and failure caused by us of GE’s distribution of our common stock to its stockholders in exchange for its common stock to qualify for tax-free treatment, which may result in significant tax liabilities to GE for which we may be required to indemnify GE.

For the reasons described above, we caution you against relying on any forward-looking statements, which should also be read in conjunction with the other cautionary statements that are included elsewhere in this news release and in our public filings, including under the heading “Risk Factors” in the Registration Statement on Form S-1, as amended and filed on July 18, 2014 (File No. 333-194528). You should not consider any list of such factors to be an exhaustive statement of all of the risks, uncertainties, or potentially inaccurate assumptions that could cause our current expectations or beliefs to change. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update or revise any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events, except as otherwise may be required by law.

©2014 Synchrony Bank/Synchrony Financial, All rights reserved.

Contact:

For Synchrony Financial

Cristy Williams, 855-791-8007

media.relations@synchronyfinancial.com