Press Release

July 28, 2016, 9:00 AM EDT

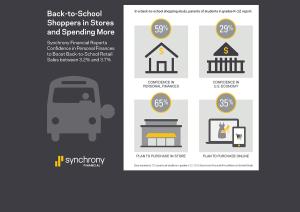

Back-to-School Shoppers in Stores and Spending More

Synchrony Financial Reports Confidence in Personal Finances to Boost Back-to-School Retail Sales Between 3.2% and 3.7%

More than 1,850 parents and college students nationwide participated in an annual Back-to-School survey1 conducted earlier this month on behalf of Synchrony Financial, a premier consumer financial services company with an 80-year heritage. The third-party study examined back-to-school shopper use of technology and purchase and payment preferences, along with Synchrony’s consumer research2 and analysis3 of key economic indicators and trends.

Clothing/shoes and electronics represent the majority of back-to-school spending for most families surveyed and more than a third expect to spend more in both categories this year. Longer supply lists and more technology needs2 are among the drivers of increased spending. More than half of parents with students in grades K-12 said they are likely to set a budget, and of those who do, 39% are more likely to set a per child budget.

“Price and value continue to influence where shoppers buy for back-to-school," said Bart Schaller, EVP and chief marketing officer, Synchrony Financial. “We consistently find shoppers are deal-driven and value the additional savings, rewards and benefits credit cards can offer.”

Findings from Synchrony Financial’s 2016 Back-to-School Study include:

Timing and Trends

- Nearly half of parents surveyed have started back-to-school shopping, and the majority of parents (51%) and college students (67%) plan to stock up after August 1.

- Supply lists have increased for 39% of parents with students in grades K-12. More than half indicate they would prefer to pay a fee for the school to provide all their supplies, and 21% consider $50 a reasonable amount.

- Parents (65%) and college students (61%) will make the majority of their back-to-school purchases in store. Nearly 40% of college students plan to buy items locally and transport to school.

Tools

- Mail and newspapers remain a significant source of advertising for parents, although down slightly from last year. Nearly 30% of parents surveyed said they find the best deals with points and savings using their credit cards.

- The search for the best deals begins online for 62% of parents (up from 56% last year) and 70% (vs. 68% last year) of college students.

- Shoppers plan to use their phones more this year to find the best back-to-school bargains – 40% of parents will use their phone to search for deals, up from 34% last year. Half of college students indicate they will use their phone to compare prices.

- Similarly, parents plan to make 35% of their purchases online and 8% say they will be using their phone. College students expect to make 39% of their back-to-school purchases online and 10% will be made using their phone. Among back-to-school shoppers surveyed, approximately 40% expect to purchase more of their clothing and shoes online this year.

Members of the media can contact media.relations@synchronyfinancial.com for additional information and insights related to the 2016 Back-to-School Study and other Synchrony Financial research.

|

Sources: |

|

|

1 |

2016 Synchrony Financial Annual Back-to-School Study, conducted June 24-July 6, 2016, by RTi Research |

|

2 |

Synchrony Financial Crowdtap Insights, July 2016 |

|

3 |

Synchrony Financial Analytics: 3.2%-3.7% based on three-month Back-to-School shopping period July-September 2016 and analysis of macroeconomic variables and trends. |

About Synchrony Financial

Synchrony Financial (NYSE:SYF) is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables.* We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 350,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Synchrony Financial (formerly GE Capital Retail Finance) offers private label and co-branded Dual Card™ credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com, facebook.com/SynchronyFinancial, www.linkedin.com/company/synchrony-financial and twitter.com/SYFNews.

*Source: The Nilson Report (May 2016, Issue # 1087) - based on 2015 data.

©2016 Synchrony Bank/Synchrony Financial. All rights reserved.

Contact:

Synchrony Financial:

Cristy Williams, 855-791-8007

media.relations@synchronyfinancial.com