Press Release

August 2, 2018, 2:32 PM EDT

CareCredit Offers More Finance Options to More Patients and Providers by Expanding into 25 New Markets

The CareCredit Health, Wellness and Personal Care Credit Card Issued by Synchrony Bank Helps Providers Grow While Helping Patients Meet Challenge of Rising Healthcare Costs

CareCredit’s growth is taking it into medical specialties including primary care and general practice, gastroenterology, physical therapy, ambulatory surgery, durable medical equipment and urgent care. The card can be used for deductibles, co-pays, planned medical procedures including orthopaedic surgery, annual wellness visits, imaging, labs and other out of pocket costs.

These markets build upon CareCredit’s more than 30-year health and wellness experience and deep relationships in the veterinary, optical, dental and cosmetic markets.

In addition to expanding in these new markets over the past 18 months, CareCredit has also launched a CareCredit Rewards Mastercard offering the ability to earn points in select categories such as health and wellness and established key strategic agreements with associations such as the American Osteopathic Information Association, American Med Spa Association and Spa Industry Association.

Currently, a large concern among providers is the transformation of the healthcare payments landscape and the increasing financial burden to the patient. This translates into increasing the length of time it takes to collect payments2 and can inhibit patients’ ability to get the care they want and need without delay. At the same time, consumer out-of-pocket spending is expected to grow from $416 billion in 2014 to $608 billion by 20193, and many patients may not be prepared to pay for their medical expenses, whether planned or unplanned. In 2017 more than 20% of adults had a major, unexpected medical bill, with an average expense of $1,200.4

“As rising healthcare costs shift the financial responsibility from traditional payers like insurers to consumers, it’s a natural progression for CareCredit to expand into new medical specialties and give even more patients access to care,” said Dave Fasoli, CEO CareCredit. “We have over a 30-year history in health and wellness and we’re committed to helping patients get the treatment they need as well as helping physicians and providers run successful and efficient practices.”

CareCredit offers promotional financing options and a simple payment calculator for consumers to compare payment options and determine monthly payment amounts. Healthcare providers receive guaranteed payment within two business days and access to resources like the Pay My Provider portal, which allows providers to accept online payments easily and, if desired, share a custom payment link with patients via email, their website or social media channels. By helping to reduce the billing and insurance-related activities that contribute to administrative costs and time, CareCredit services can free up valuable time to allow providers and their staff to focus more on providing high-quality care and a positive patient experience.

About CareCredit®

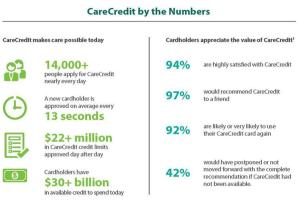

For 30 years CareCredit, a Synchrony solution (NYSE:SYF), has helped millions of people pay for needed and desired care and health expenses. CareCredit is a health, beauty, wellness and personal care credit card accepted through a national network of more than 200,000 healthcare provider locations and select health-focused retailers. For more information on CareCredit, call 800-300-3046 or visit www.carecredit.com. For more information about Synchrony Financial visit www.synchronyfinancial.com.

1 CareCredit Cardholder Engagement Study, Q2 2018

2 Healthcare Payments Benchmark, Wave 2 Report on Findings, December 2017, conducted for CareCredit by Chadwick Martin Bailey

3 InstaMed, Trends in Healthcare Payments Eighth Annual Report: 2017, May 2018

4 Ibid