Press Release

July 24, 2015, 8:00 AM EDT

Confident Back-To-School Shoppers Still Look for Best Values, Synchrony Financial Study Finds

Shoppers plan to spend same or more, but will set budget and seek bargains online

Dateline:

STAMFORD, Conn.

Public Company Information:

NYSE: SYF

STAMFORD, Conn.--(BUSINESS WIRE)--Parents shopping for back-to-school clothing and supplies for their children are confident about their finances, but still very cost-conscious and careful to find the best value, according to Synchrony Financial’s 2015 Back-To-School Shopping Study.* Before bells begin to ring in a few weeks, parents and students are sorting through what they can use from last year, searching online for the best deals, and stocking up on supplies in-store.

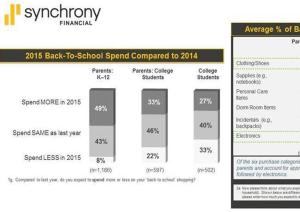

Synchrony Financial (NYSE:SYF), a premier consumer financial services company with 80 years of retail heritage, today released findings from its 2015 Back-To-School Shopping Study, examining spending across six categories, use of technology, and retail and payment preferences. The survey was conducted July 7-14 on behalf of Synchrony Financial by RTi Research, with more than 2,000 participants in three groups: parents of children in grades K-12; parents of college students; and college students.

Price is an overriding concern for parents, even though most report they plan to spend the same or more this year. More than half of parents with students in grades K-12 are likely to set a budget for back-to-school expenses. College students are focused on items they need – 83% plan to reuse where possible and replenish essentials, and 63% will refer to last year’s spending as a guideline. Regardless of purchase or shopper category, more than half seek deals online. However, supplies are most likely to be purchased in-store by 80% of college parents; 74% of college students; and 77% of K-12 parents. Nearly half of K-12 parents reported increases in supply lists over last year.

Value is the overwhelming driver when deciding where to shop, according to the study. Components of value include competitive prices, deals and merchandise quality. Respondents also rate a convenient location, a variety of products, a flexible return policy, service and free shipping among the most important considerations in determining where they will buy for back-to-school.

“Our findings indicate parents and students will fulfill their back-to-school needs with an eye toward finding deals,” said Toni White, chief marketing officer, Synchrony Financial. “Although the study found shoppers are confident and optimistic, their focus on value and time spent comparing prices online reinforces the importance for retailers to have integrated strategies that provide relevant offers and the best multi-channel experience.”

Other key findings from Synchrony Financial’s 2015 Back-To-School Shopping Study include:

- Category Spend

Of the six purchase categories studied, clothing and shoes are the largest expense for parents and account for approximately one-third of their total back-to-school spend, followed by electronics. College students spend primarily on electronics, clothing and dorm room items.

- Timing

Back-to-school shopping begins before August 1 for nearly half of K-12 parents, and 51% said they already started shopping or plan to do so earlier than last year. Consistent with previous years, college students and their parents shop largely between July 15 and August 15.

- Digital Tools Support Shoppers

In their quest for back-to-school bargains, many shoppers rely on their smartphones. More than half of college students use their phone to comparison shop, and more than one-third of K-12 parents search for coupons and online deals with their phone. Social media enables 46% of college students to compare prices and more than 30% of them – and parents of K-12 children – watch for deals on brands they follow.

The Synchrony Financial Market Research team provides insights into consumer attitudes and perceptions toward the retail brand, products and platforms to improve customer satisfaction. Through the Synchrony Connect program, Synchrony Financial partners can connect with subject matter experts to gain knowledge and expertise beyond credit to help them grow, lead and operate their business. More information can be found at www.SynchronyFinancial.com.

About Synchrony Financial

Synchrony Financial (NYSE:SYF), formerly GE Capital Retail Finance, is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables**. We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations, and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 300,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Our offerings include private label and co-branded Dual Card credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com and twitter.com/SYFNews.

Sources: *Synchrony Financial Back-To-School Shopping Study, July 2015

**The Nilson Report (April, 2015, Issue # 1062) - based on 2014 data

Topics: Back-to-school, Retail, credit cards, shopping, smartphones, consumers, students

Editor Note: Graphic data representations available

©2015 Synchrony Bank/Synchrony Financial, All rights reserved.

Contact:

For Synchrony Financial

855-791-8007

media.relations@synchronyfinancial.com