Press Release

March 19, 2017, 12:53 PM EDT

Synchrony Financial Looks Ahead to 2030 in Future of Retail Study

Converging channels, customization and constant connectivity to impact the shopping sector

Building on input from retailers and industry experts, consumers were asked what excites them about shopping in the future and their expectations of the evolving retail environment. Findings from the multiphase research is organized into six core themes:

Do-It-Yourself Retail: The Evolution of Self-Service

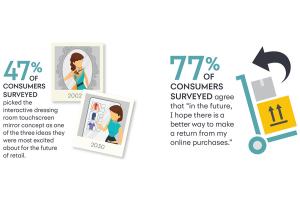

Technology will bring a new era of DIY shopping – changing how shoppers access, select and pay. The self-serve retail model, 24/7 stores with robot-assisted drive-thru windows, and interactive mirrors will become mainstream. Nearly half (47%) of consumers surveyed ranked interactive touchscreen mirrors in dressing rooms among the top three most exciting innovations of the future.

“Findings show shoppers seek self- and on-demand service, increased customization, and seamless home and in-store integration,” said Whit Goodrich, CMO Retail Card, Synchrony Financial. “By having a pulse on the evolving desires of the American consumer, we’re able to pioneer new solutions to help retailers deliver a better shopping experience with tailored loyalty benefits and rewards.”

Automation Nation: Using Smart Data to Deliver Customization

Consumers will expect retailers to tap into the personal information they willingly provide to deliver better customized products and offers. From RFID in phones and wearables to biometrics such as finger and palm scanners, retailers will know shoppers well enough to direct them to preferred in-store items and send immediate and individualized sales offers. In-home chat bot devices and unbiased experts within “digital assistants” will become popular.

“One of the biggest disrupters in retail in the future could be 3D printing – footprints to create shoes and ways to produce many things faster and more inexpensively in a manner we never could before. It’s mass customization,” said Courtney Gentleman, CMO, Payment Solutions, Synchrony Financial.

Retail On-Demand: We Want It Now

Increasingly, technology will give rise to a more demanding shopper base – one that expects what they purchase to be instantly available or returned. Among consumers surveyed, 77% anticipate better ways of making returns from online purchases in the future. Instant gratification will be an important part of the shopping experience offered in the form of stores on wheels, trunk stores, pop-up shops and subscription services; return buttons in retailer apps that re-package and pick-up items; and real-time inventory views and better ship-to-store options.

Retail Comes to You: Bridging the Gap Between Home and Store

The confluence of channels and high-definition camera technology will enable shoppers to access an interface through virtual or augmented reality to see how a new sofa, fabric and paint, garage door, flooring or other items will look in their house. Consumers will be able to secure in-home retailer services, purchase on demand using smart labels or QR codes, shop in 3D and use instant try-on features.

“Why have anything altered again?” said Bart Schaller, CMO, Synchrony Financial. “Shoppers will be able to take a perfectly dimensioned picture of a person’s body, type and form and upload it to retailer apps. Without moving from the sofa, a pair of pants will arrive at their doorstep ready to go.”

Brick-and-Mortar’s Reason for Being: Entertainment and Engagement

Brick-and-mortar stores of the future will focus on delivering genuine brand experiences to build both trust and loyalty – tapping into consumer desires. More than half of study participants (55%) are excited about blended in-store and entertaining experiences such as coffee shops, cafés, music, bars, or complimentary samplings of products or services.

Less is More: Streamlining of Brands

Instead of appealing to everyone, 57% of consumers agree that retailers must streamline and focus on doing one or two things well. Specialty retailers will remain a go-to in high-involvement categories, while online and automated reordering will reduce the need for as many one-stop-shop stores. Regardless of category, brands of the future must have a strong reason for being.

Adds Goodrich, “The future of retail will look dramatically different in 2030 than it does today. We’re urging retailers to begin planning for that future now, and our emerging trends analysis is just the start.”

Study Methodology

The Future of Retail report was developed from multiple research phases conducted January-February 2017 on behalf of Synchrony Financial with consumers and industry experts including:

- Consumers – A quantitative study with 1,016 consumers and online discussions and half-day workshops in two U.S cities spanned generational groups 18 years and older; ethnic and socio-economic backgrounds; and online and in-store shoppers.

- Retail Experts - Input contributed from Synchrony retail partners across different industries, representing online only, mass merchandisers and middle market businesses. One-on-one interviews with a retail futurist; in-store and digital retail technology professionals; and Synchrony business leaders in strategy and innovation, marketing and IT.

The Future of Retail brief can be downloaded and viewed, along with forthcoming insights and videos on this topic and other research at http://synchronyfinancial.com through the “Insights” link under the “News” tab. For more information about how Synchrony Financial can help grow business, go to www.synchronyconnect.com or email synchronyconnect@synchronyfinancial.com.

About Synchrony Financial

Synchrony Financial (NYSE:SYF) is one of the nation’s premier consumer financial services companies. Our roots in consumer finance trace back to 1932, and today we are the largest provider of private label credit cards in the United States based on purchase volume and receivables.* We provide a range of credit products through programs we have established with a diverse group of national and regional retailers, local merchants, manufacturers, buying groups, industry associations and healthcare service providers to help generate growth for our partners and offer financial flexibility to our customers. Through our partners’ over 350,000 locations across the United States and Canada, and their websites and mobile applications, we offer our customers a variety of credit products to finance the purchase of goods and services. Synchrony Financial offers private label and co-branded Dual Card™ credit cards, promotional financing and installment lending, loyalty programs and FDIC-insured savings products through Synchrony Bank. More information can be found at www.synchronyfinancial.com, facebook.com/SynchronyFinancial, www.linkedin.com/company/synchrony-financial and twitter.com/SYFNews.

*Source: The Nilson Report (May 2016, Issue # 1087) – based on 2015 data.

©2017 Synchrony Bank/Synchrony Financial. All rights reserved.

Contact:

For Synchrony Financial

855-791-8007

media.relations@synchronyfinancial.com

.jpg)