White Paper

November 4, 2015, 4:48 PM EST

In-Store Shopper Segmentation Study

DOWNLOADAuthor

Sr. Market Research Manager

Contributors

Chief Commercial Officer

David Liebskind

Abstract:

Table of Contents

The in-store experience is as critical as ever.

Glenn Marino, EVP and CEO, Payment Solutions, Chief Commercial Officer

Study Background

IN-STORE SHOPPER SEGMENTATION STUDY

|

Qualitative Research |

Quantitative Research |

|

|

October 2013 |

January 2014 |

|

|

|

|

|

|

Six focus groups in Denver and Charlotte |

Online survey |

|

In-store Truths

- 62% of shoppers agree that, “If I have to go to a store, I want to get in and out quickly with no hassle.”

- 50% of shoppers completely agree that, “I will go out of my way to find a great price.”

- 46% of in-store shoppers say it is very important for a store to have the “right amount of signage.”

- 6 out of 10 expect in-store signage to clearly communicate the latest promotions and deals.

- 68% agree that it is important that signage be easy to read and clearly state which products qualify for the promotions being communicated.

- Helpful associates

- Easy store navigation

- Clear product details

- Clean store

- Easy return process

Shoppers want information on the store credit card benefits but do not want to feel pressured to sign up.

After a shopper has navigated through the store and narrowed their search, they then look for information on payment options.

53% say it is very important for an associate to be able to confidently speak to the basics of the store credit card program/offers.

56% say it is important to have at least basic store credit information on signage.

76% do not want to feel pressured to apply for store credit offers.

In the majority of categories, shoppers spent more than they intended.

Shoppers spent somewhere between 25-35% more than they intended.

Another consistent theme in the research was that shoppers ended up spending, on average, more than they expected to spend.

This was often due to incorrect price assumptions, finding something they preferred that cost more, or increased buying power from using a financing promotion on a store specific credit card.

Introducing the in-store shopper segments

In-store signage plays a critical role in the major purchase process; however, expectations around the use of technology, amount of signage, and information being conveyed varies by shopper segment. Segment size varies by product category and will be outlined below.

- RecommendationsBeing appreciative and relying heavily on associate help and recommendations.

- Preferring to shop in-store (vs. online) for the associate interaction.

- Expecting the associate to clearly communicate the latest sales/promotions.

- Are open to using store credit cards (the most open of all the segments).

- Expecting the associate to remind them to use their store loyalty card at checkout.

- Provide this shopper all the attention they need.

- Review and know details of latest product innovation.

- Be genuine, listen, and provide unique recommendations.

- Promote the benefits of the store credit card and loyalty cards early and often throughout their shopping trip.

- Convey the monetary savings of using their store card or loyalty card at checkout.

Penetration by Category

Apparel. . . . . . . . . . . .23%

Auto parts. . . . . . . . . .39%

Home durables. . . . . .41%

Electronics. . . . . . . . .42%

Luxury. . . . . . . . . . . . .42%

Outdoor. . . . . . . . . . . .42%

- Being focused on a no hassle experience with the majority agreeing, “I want to get in and out quickly.”

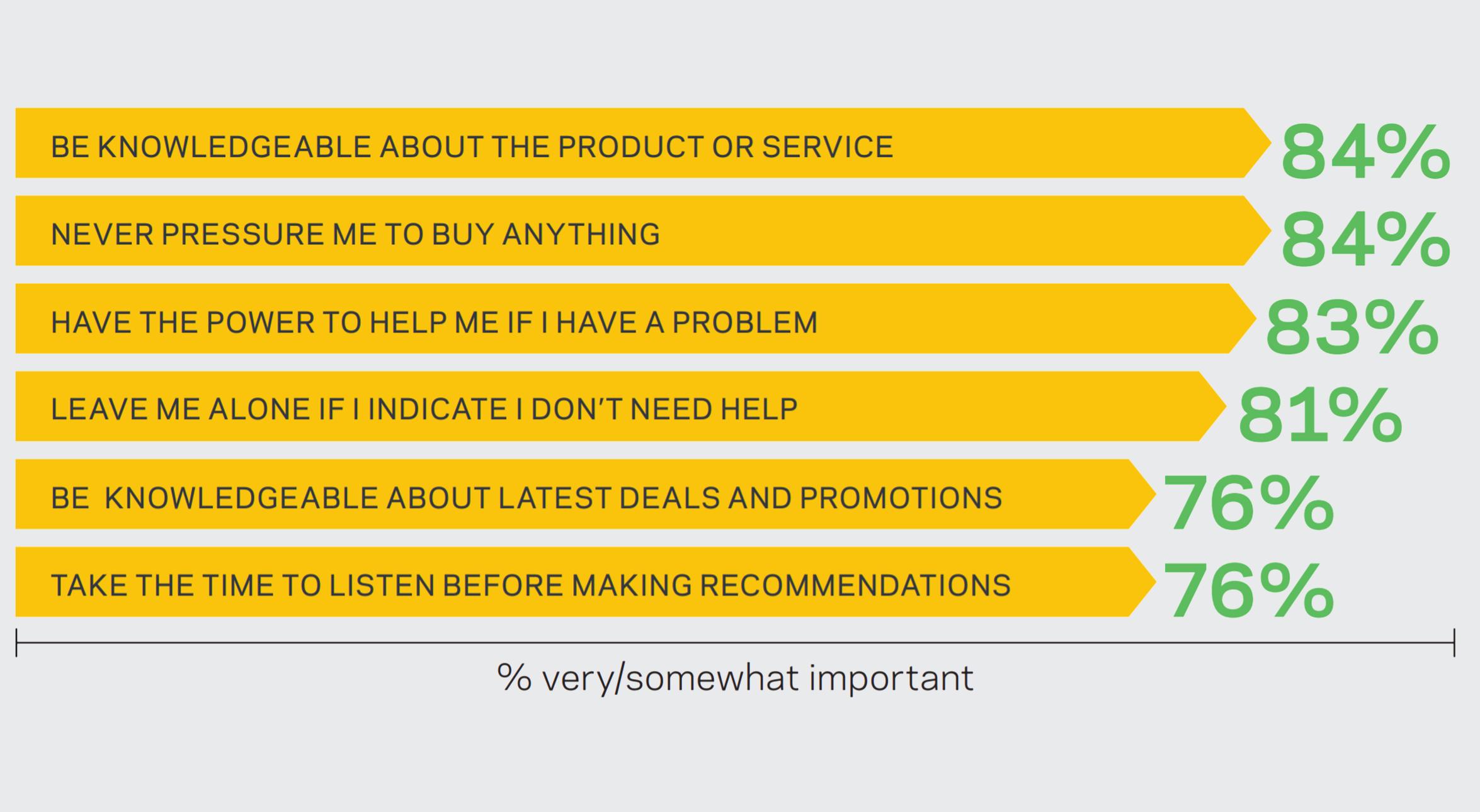

- Expecting associates to be knowledgeable about the product/category they are selling.

- Expecting the associates to have the “power to help me if I have a problem” (e.g., returns, warranty, delivery issue).

- Assuming the associates will be “available when I need help” and “help me find what I need.”

- A little over half are open to store credit but don’t want to feel pressured. They will seek information on their own.

Recommendations

- Apply a “no pressure” sales approach. Be there when they request your help; otherwise, give this shopper space.

- Be prepared to answer technical questions.

- Provide easily accessible information on the return policy, product warranty, and delivery.

- Communicate basic store credit and loyalty card benefits once at checkout.

Auto parts. . . . . . . . . .36%

Home durables. . . . . .31%

Electronics. . . . . . . . .29%

Luxury. . . . . . . . . . . . .30%

Outdoor. . . . . . . . . . . .29%

- Being focused on a no hassle experience with the majority agreeing, “I want to get in and out quickly.”

- Wanting the store to have self-service price scanners so, “I know how much something costs without having to speak to someone.”

- Never wanting to feel pressured to buy something.

- Wanting to be left alone if they indicate they don’t need help.

- Apply a “no pressure” sales approach - be there when they need you, otherwise give this shopper space.

- In-store signage will be important to this shopper as they will rely more heavily on written materials than associate communication.

- Provide an in-store experience that allows this shopper to get in and out quickly.

- Provide self-service price scanners and potentially self-service checkout for this shopper.

Apparel. . . . . . . . . . . .32%

Auto parts. . . . . . . . . .12%

Home durables. . . . . .17%

Electronics. . . . . . . . .14%

Luxury. . . . . . . . . . . . .12%

Outdoor. . . . . . . . . . . .16%

- Checkout anywhere in the store using associates’ mobile devices.

- Easy access to 3rd party product reviews within the store.

- A kiosk for self-checkout.

- Digital or interactive signage for gathering information.

- Augmented reality via in-store signage.

- QR codes on signs to access additional product information.

- Integrate technology into the store experience via self-checkout and consider using a mobile device for quick associate checkout or as a sales tool.

- Take your in-store signage to the next level by integrating video or augmented reality.

- Consider including a call-to-action on your credit signage—like “Text to Apply”— and other mobile options for customers to apply on their smartphone in-store.

Apparel. . . . . . . . . . . .15%

Auto parts. . . . . . . . . .13%

Home durables. . . . . .10%

Electronics. . . . . . . . .15%

Luxury. . . . . . . . . . . . .16%

Outdoor. . . . . . . . . . . .12%

Summary and Recommendations

best attract and retain them.

- Marketing spend and engagement in the right channels

- In-store experiential requirements

- Creative/messaging

- Value proposition enhancements

- Competitive strategies

- Proactive retention

- Customer service

- Technology investment and integration

“When implemented strategically, shopper segmentation can be a powerful tool that can lead to incremental sales, grow profitability, and reduce customer attrition.”

Glenn Marino, EVP and CEO, Payment Solutions Chief Commercial Officer